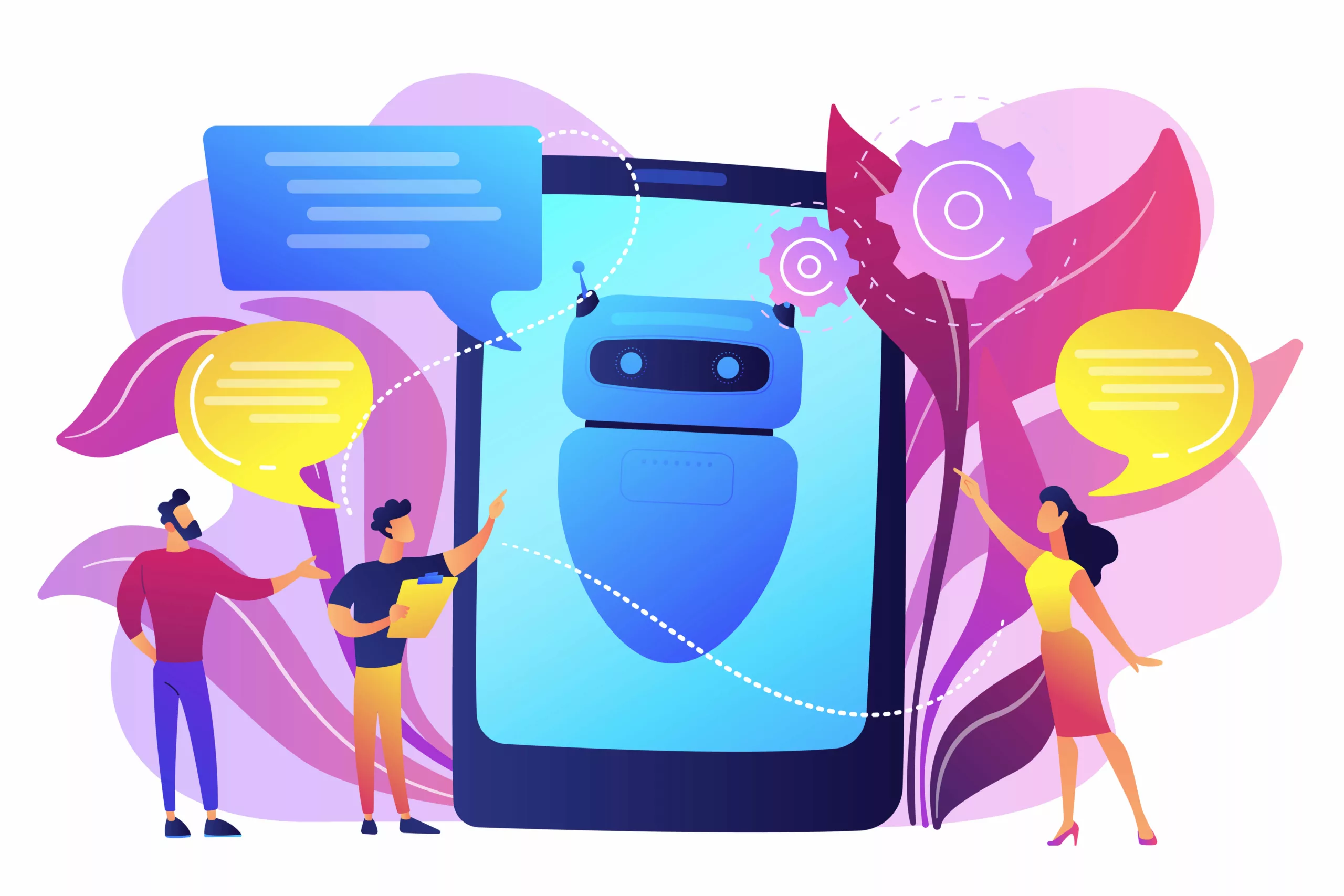

Have you ever wondered how insurance agencies are keeping up with the fast-paced demands of customers today? Imagine getting instant answers to your queries, quick policy updates, and personalized assistance without waiting. Sounds convenient, right? This is the new era of customer engagement in insurance, powered by AI chatbots. But how exactly are these AI chatbots transforming the way insurance agencies interact with their customers? Let’s dive in and find out!

What is Insurance Chatbot?

An insurance chatbot is a virtual assistant created to help insurance businesses interact with their customers. It uses artificial intelligence to decode queries and answer politely, like speaking with a real person. Insurance chatbots can respond to enquiries about insurance, help with claims, and provide estimations, allowing clients to receive help swiftly. They can be utilized on corporate websites, apps, and messaging platforms such as SMS or WhatsApp, ensuring that support is always available when required.

Benefits of Chatbots in Insurance Agencies

1. Cost Effective

Insurance chatbots may help businesses save a significant amount of money by managing routine enquiries and duties, such as supplying quotations or responding to general policy concerns. This allows human agents to focus on more significant and difficult issues that require personal attention. Chatbots accelerate and improve the efficiency of the entire process by automating these common processes, resulting in decreased company expenses. This saves money and allows insurance firms to give better service to their consumers without overloading their resources.

2. 24/7 Customer Support

One of the most important benefits of insurance chatbots is their availability throughout the day and night. Chatbots, unlike human agents, do not require breaks or sleep, allowing them to give quick support to customers as required. Customers can get assistance with their enquiries or difficulties at any time, including late at night and on weekends. This round-the-clock service ensures that customers feel cared for and pleased particularly when they have important enquiries beyond regular office hours.

3. Improved Security

Protecting customer data is critical in the insurance sector, and chatbots can help with this. Advanced chatbots, particularly those that use AI, are designed to handle sensitive data safely, ensuring that everything remains private and adheres to strict data protection guidelines. Chatbots eliminate the need for human interaction in data-related tasks, lowering the danger of errors or data breaches. This makes chatbots a dependable tool for safeguarding consumer data while offering prompt and effective assistance.

4. Customer Satisfaction

Chatbots keep clients engaged and pleased by giving prompt and useful replies. They can connect to systems that save data about customers, allowing them to provide personalized support that seems unique to each customer. This personal touch helps clients feel valued and enhances their entire experience, transforming ordinary interactions into enjoyable ones. Chatbots help to keep consumers engaged and satisfied by being quick, polite, and informative.

5. Boost Productivity of Agency

Chatbots automate regular and repetitive operations, allowing human agents to concentrate on more complex and essential concerns. Chatbots free up agents’ time to focus on activities that require human attention and expertise. This change increases overall productivity and improves the quality of service by allowing agents to focus their expertise and empathy on more difficult situations that require a human touch.

6. Multilingual Support

Modern insurance chatbots can speak a variety of languages, which is a significant advantage for businesses that service a wide range of consumers. It helps to overcome language barriers, making it easier for people from diverse backgrounds to obtain the assistance they require. Some sophisticated chatbots, for example, can communicate in over 135 languages and dialects, both written and spoken. This skill not only expands the company’s reach, but it also decreases the need to hire multilingual employees, lowering operating expenses and enhancing customer service.

7. Streamlined Claims Processing

Processing claims in insurance can be difficult and time-consuming. Chatbots simplify this process by assisting clients in filing claims, keeping them updated on the status, and addressing any concerns they may have. This automation speeds up the entire process, lowers errors, and improves the overall client experience. For insurance firms, it implies a more efficient system with fewer errors, resulting in faster and more accurate settlements of claims.

Wrapping Up!

Insurance chatbots are significantly improving how insurance firms help their customers. They offer 24-hour assistance, protect data confidentiality, and simplify complicated operations like handling claims. By automating repetitive operations, chatbots allow human agents to focus on more essential concerns, increasing productivity and customer satisfaction. Their multilingual skills also assist companies overcome language barriers and broaden market reach, all while lowering operating expenses.

At eBotify, we specialize in designing customized chatbot solutions for insurance businesses. Our chatbots can smoothly manage client interactions, provide personalized support, and provide useful insights to help you improve your business.

Are you ready to transform your insurance agency’s customer service? Get in touch with us and streamline your operations with eBotify now!